defer capital gains tax uk

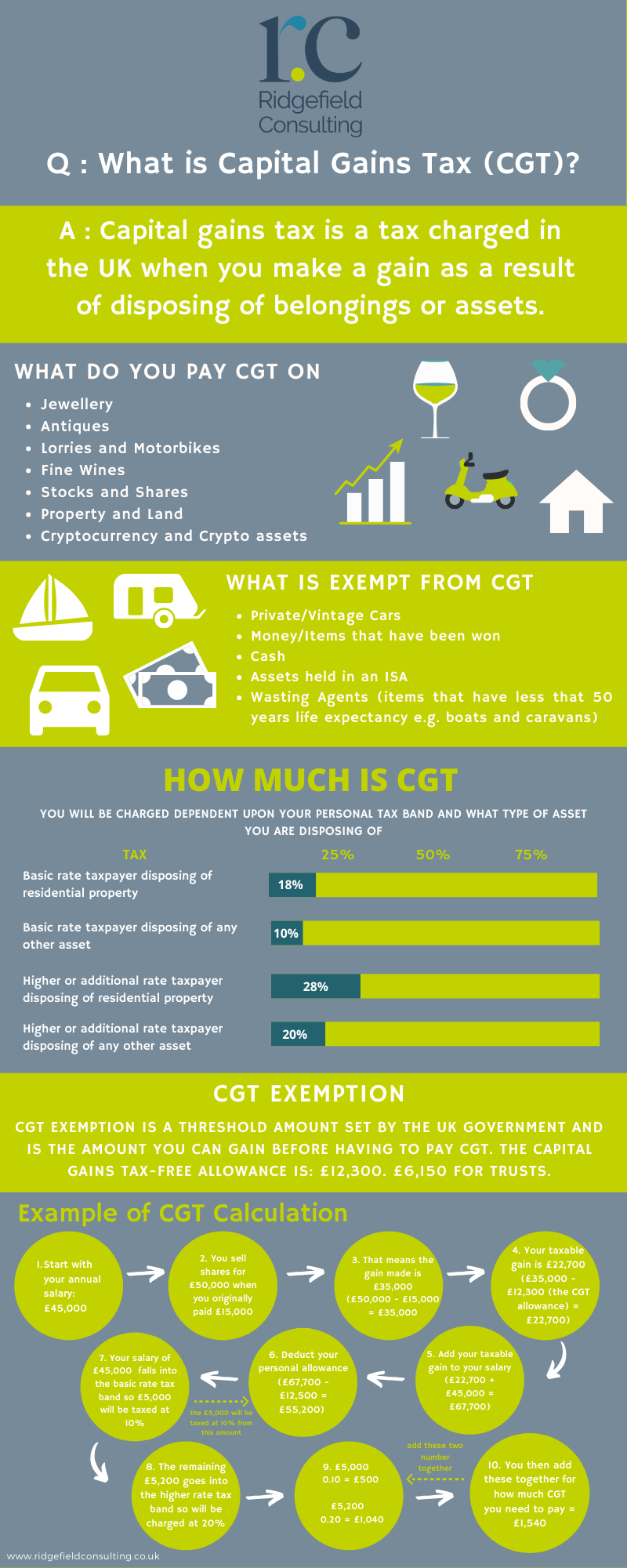

Capital gains tax CGT is levied on capital gains made on disposals including gifts of most assets eg. Do you have a CGT liability coming up.

Managing Tax Rate Uncertainty Russell Investments

In overview ER provides a lower capital gains tax rate of 10 as compared to a standard rate of 20 on gains arising when disposing of qualifying assets.

. Mrs Smiths advisor mentioned that she could defer payment of capital gains tax by investing the capital gain minus her annual CGT allowance of 57700 in to an EIS. Chargeable Gain if shares held 3 years Nil. If you invest that 250000 gain in a QOF within the required 180-day period you can defer the gain and the tax on the sale.

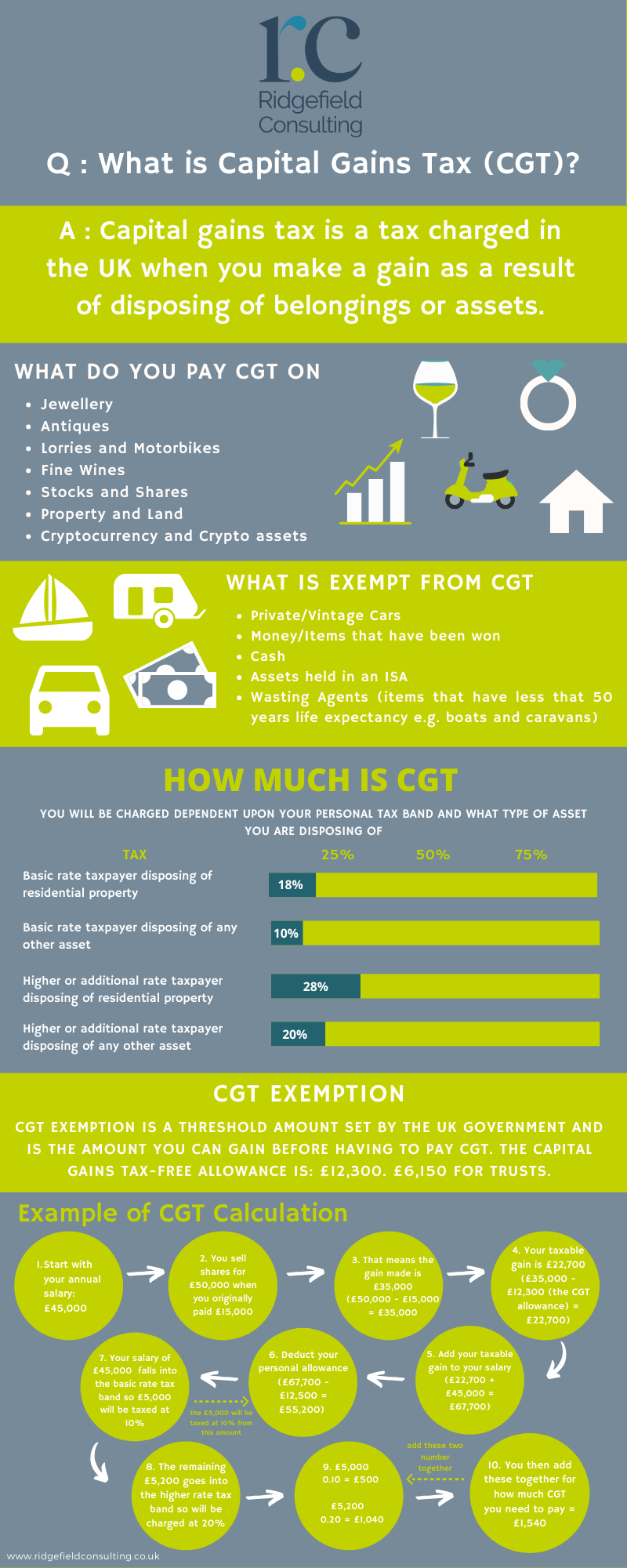

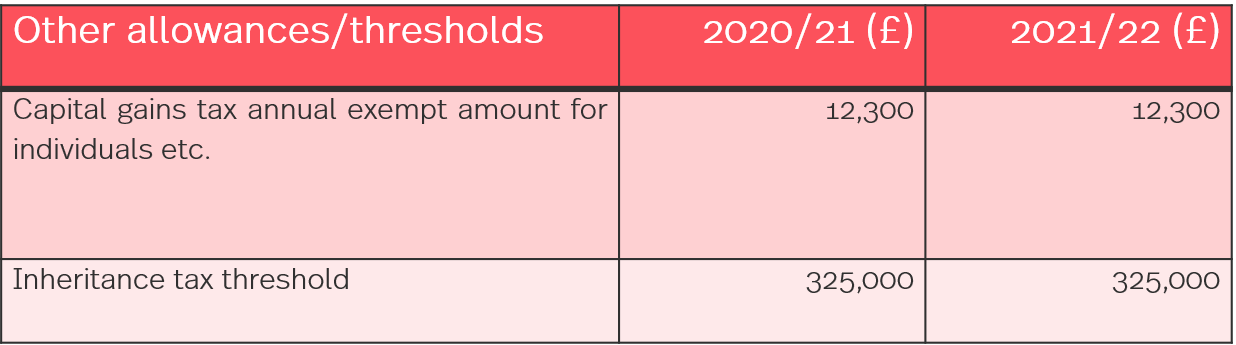

Here are some ways to potentially reduce your capital gains tax liability. 1 Use your CGT exemption Everyone has an annual CGT exemption which enables you make tax-free gains of up to 12300 in the 202122 tax year. Using the 12300 allowance will prevent it from being carried forward into the next fiscal year unless you use it later.

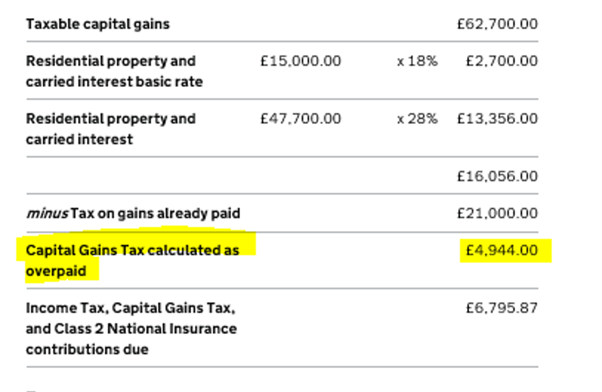

How Long Can You Defer Capital Gains Tax. If so with a bit of planning it may be possible to defer your CGT liability and even claim a repayment for tax already paid. Because of the COVID-19 pandemic the.

Deferring the property gain individuals. ER is subject to a lifetime limit for individual investors of 10m. The tax on those capital gains is deferred until the end of.

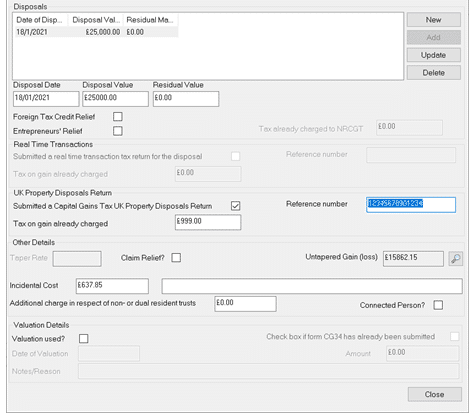

These are discussed below. Deferring Capital Gains Tax on UK property disposals. Deferral relief allows a UK resident investor to defer capital gains tax.

Antiques by individuals at two rates namely 18 andor 28. Investing a taxable gain in an EIS allows you to defer it for as long as that money remains invested. There is also 30 Income Tax relief on the investment.

Income tax relief 30 30000 Capital Gains Deferral CGT 20 20000 Net Cost to Investor. Capital gains tax deferral allows a uk resident investor to defer capital gains tax cgt on a chargeable gain from the sale of any asset or a gain previously deferred by investing in new shares of a qualifying unquoted trading company. You defer a gain of 50000 arising in 2014 to 2015 by subscribing 50000 for EIS shares issued on 10 March 2014.

Depending on the nature of the asset disposed of this can result in the individual paying capital gains tax CGT at 20 or 28 in tax years where their taxable income and gains exceed the basic rate threshold 37700 for the 202122 and 202223 tax years but only 10 or 18 on gains in years where their net income and gains are lower than that threshold. Capital gains tax EIS deferral relief. 100000 Capital Gain Invested via EIS.

Have you paid Capital Gains Tax CGT in the last few years. By using your allowance you can reduce your capital gains tax bill. Assumed return of 2x amount invested.

Take into account any losses that are against gains. Investment Period Extended To Defer Capital Gains. It would be a good idea to create an all-in-one fund.

Some countries such as Spain have a form of deferral relief where a main residence is sold and the proceeds are reinvested in more qualifying property. Firstly its important to note that there is no general provision allowing CGT on a residential property to be avoided by simply reinvesting the proceeds. There are various capital gains tax reliefs which an individual can utilise to defer the capital gain on a property disposal until a later time thereby postponing the tax bill.

If the gain is re-invested into a Seed EIS in the same tax year CGT relief of 50 is given. The annual exempt amount for the 2020-21 tax year is 12300. Invest in a securities firm for at least one year and invest in the same stock firm for at least three years then reduce the amount of capital gains tax by 10 and 15.

Deferring your Capital Gains Tax liability. If you sell all the EIS shares in March 2019 the whole of the deferred gain of. Are you considering investing in a business.

This measure deals with the deferment of payment of Capital Gains Tax by certain UK resident trusts or non-UK resident individuals who trade. Normally to defer the taxable capital gains into a QOF the profit must be reinvested into a QOF within 180 days of the sale date. Deferral of exit charge payments for Capital Gains Tax.

Malcolm Finney explains when and how capital gains tax can be deferred on gifts of assets standing at a gain. For realized but untaxed capital gains short- or long-term from the stock sale. Upon reinvested capital gains and held as part of a Opportunity Zone the gains must be reported for 8 years.

Invest capital gains in EIS to defer tax. Q If I sell a buy-to-let property and immediately use proceeds to buy another is the payment of capital gains tax deferred. Everyone is allowed to make a certain amount of tax-free capital gains each year.

Tax relief for reinvestment of gains in qualifying schemes is intended to stimulate investment in small businesses and is incorporated into the enterprise investment scheme EIS as EIS deferral relief. Deferred Gain Becomes Chargeable. The ability to defer capital gains tax by reinvesting in venture capital trusts was scrapped from 6 april 2004.

CGT is normally charged at a simple flat rate of 20 and this applies to most chargeable gains made by individuals. Shares Sold Hypothetical Value. Tax Payable on Deferred Gain.

You can defer payment of CGT by re-investing the capital gain into an Enterprise Investment Scheme EIS. This provides a ready supply of venture capital to growing businesses. Deferred tax is the amount of tax payable or recoverable in future reporting periods as a result of transactions or events recognised in current or previous periods accounts.

There is a lower rate of 6150 for most trustees. Generally FRS 102 adopts a timing difference approach ie deferred tax is recognised when items of income and expenditure are. The good news is there remain ways to reduce capital taxes or even to eliminate them altogether.

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gains Tax Guide For Businesses Taxassist Accountants Taxassist Accountants

What Is Capital Gains Tax Cgt Ridgefield Consulting

What Is Capital Gains Tax And When Are You Exempt Thestreet

What Is Capital Gains Tax And Will A New Raid On Wealth Affect You This Is Money

Capital Gains Tax Cgt Holdover Relief Trusts Mercer Hole

What Is Capital Gains Tax Cgt Ridgefield Consulting

Cgt On Property 30 Day Reporting Issues Process For Offset Of Cgt Overpayment

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Personal Tax Disposal Of Property Capital Gain 30 Days And How To Enter Tax Paid On It Iris

Capital Gains Tax Examples Low Incomes Tax Reform Group

How To Reduce Your Capital Gains Tax Bill Vanguard Uk Investor

How To Avoid Or Cut Capital Gains Tax By Using Your Tax Free Allowance Getting An Isa And More Lovemoney Com

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)